We focus on investing in shares of high quality companies that have high potential of growth and also that trade at substantial discounts to our conservative estimates of intrinsic value.

OUR MISSION IS TO EMPOWER INVESTOR TO ACHIEVE FINANCIAL FREEDOM AS EARLY AS POSSIBLE .

EXPERIENCE

CEO, HEAD DIRECTOR

WE BELIEVE THE MOST IMPORTANT THINGS AS AN INVESTOR ARE .

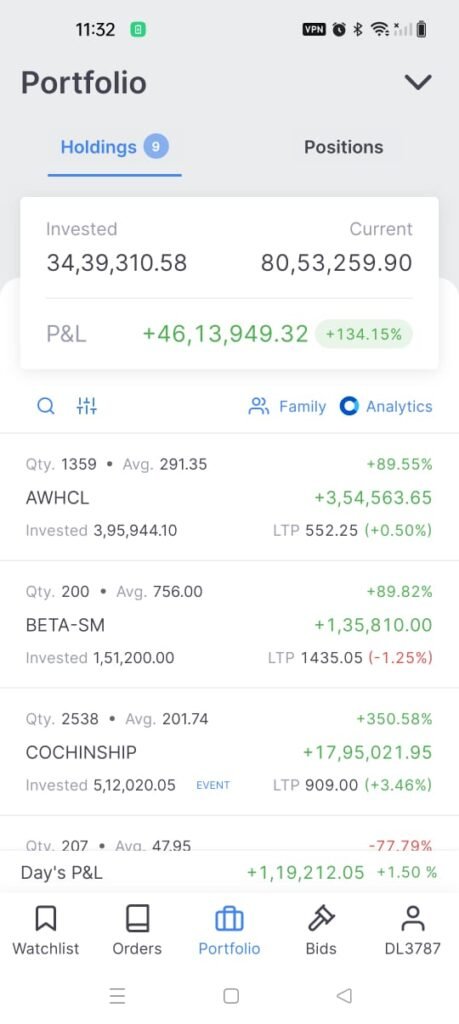

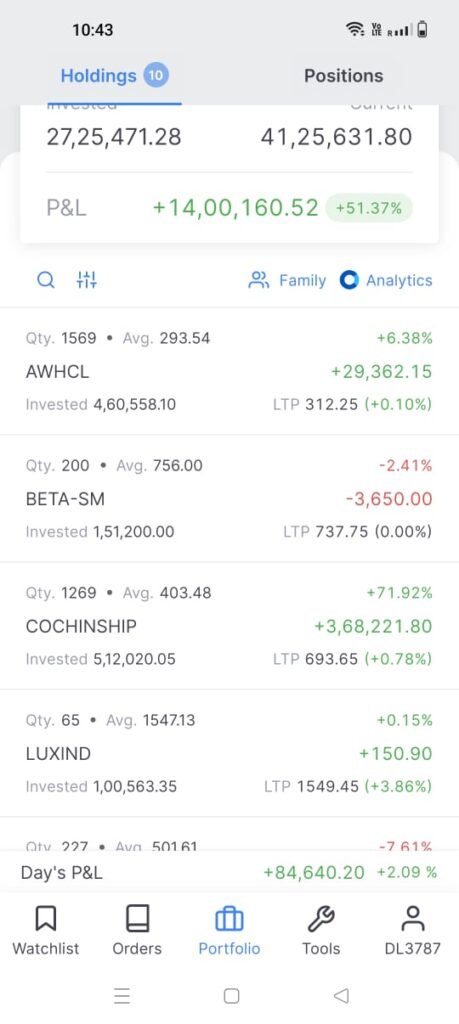

Through our fundamental, value-oriented investment process we aim to buy stocks of high quality companies that trade at substantial discounts to our conservative estimates of intrinsic value. And then construct concentrated portfolio which are having only 4 to 5 stock , the allocation amount depend on risk and reward , maximum allocation 40 % in one stock , when odd are in our favor The selection is limited to Companies listed on the Indian stocks exchanges (BSE or NSE) but independent of industry, or index considerations, resulting in a portfolio that is built from the bottom up and based on the best value opportunities currently available.

Note :- The concentrated portfolio is volatile in nature and not performing yearly but within 3 year it perform and reward handsomely .

Through our fundamental, value-oriented investment process we aim to buy stocks of high quality companies that trade at substantial discounts to our conservative estimates of intrinsic value. And then construct concentrated portfolio which are having only 4 to 5 stock , the allocation amount depend on risk and reward , maximum allocation 40 % in one stock , when odd are in our favor The selection is limited to Companies listed on the Indian stocks exchanges (BSE or NSE) but independent of industry, or index considerations, resulting in a portfolio that is built from the bottom up and based on the best value opportunities currently available.

Note :- The concentrated portfolio is volatile in nature and not performing yearly but within 3 year it perform and reward handsomely .

Investment in equities is subject to market risks. Not with standing all the efforts to do best research, clients should understand that investing in equities involves a risk of loss of both income and principal. Please ensure that you understand fully the risks involved in investment in equities.

Copyright © 2025 Valuable Research. All rights reserved.